Zensus und Grundsteuerreform

Zensus und Grundsteuerreform – Best Practice mit iTWO fm

Bei einem CAFM System denken die meisten Personen an nüchterne Raum- und Gebäudeverwaltung, Mietmanagement und Nebenkosten. Dass mit Bordmitteln auch der aktuell laufende Zensus und die anstehende Grundsteuerreform gemeistert werden können, zeigt Georg Daher, Leiter Facility Management bei der Baunataler Diakonie Kassel, in diesem Best Practice-Beispiel.

Derzeit sind zwei Befragungen zum Zensus in Deutschland in der Umsetzung. Zum einen werden durch die Landkreise und Städte Wohnheime und besondere Wohnformen abgefragt, und im Rahmen des Mikrozensus wird durch die Landesämter die Wohnraumsituation ermittelt.

Kommunaler Zensus

Die von den statistischen Stellen bereitgestellten Onlineformulare können im kleinen Rahmen händisch eingepflegt werden. In einem Fall wie unserem mit über 50 Wohnheimen und über 1.000 Bewohnenden, die es darzustellen gilt, nutzt man besser sein CAFM-System und verbessert damit am Ende seinen eigenen Datenbestand, auch um für den nächsten Zensus vorbereitet zu sein.

Wie Sie wissen ist iTWO fm vom Grundsatz her klassenorientiert. Als Nutzende haben wir die Möglichkeit, eigenständig Klassen zu erstellen, Attribute innerhalb der Klasse hinzuzufügen und Klassen miteinander zu verknüpfen. Die Verbindungen können in Baumstrukturen oder durch Beziehungen untereinander gelöst werden. Dank dieses wertvollen Prozessablaufs kann die nutzende Person mit wenigen Klicks komplexe Lösungen erstellen.

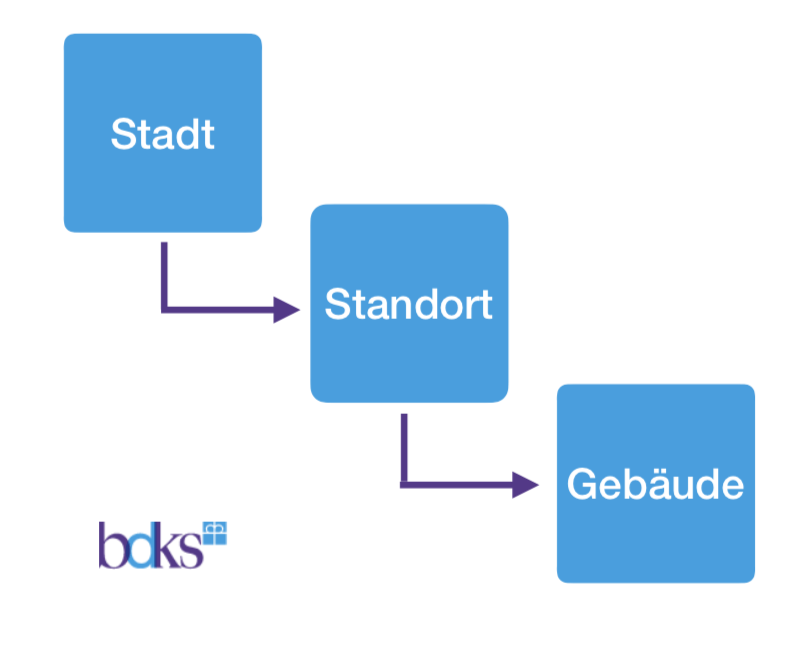

Wir als Baunataler Diakonie Kassel haben die Standardeinstellungen von iTWO fm für unseren Strukturaufbau im Einsatz und nutzen seit vielen Jahren diese drei regulären Klassen:

Für den kommunalen Zensus sind lediglich die richtigen Attribute bzw. Datenfelder in den Klassen nötig. Es sind:

- • In der Klasse „Stadt“ wird die Schlüssel-Nummer des Allgemeinen Gemeindeschlüssels (AGS) hinterlegt

- • In der Klasse „Standort“ haben wir die Adressdaten eingetragen

- • In der Klasse „Gebäude“ sind zu finden:

- o NRF saldierte Flächen des Gebäudes

- o Ansprechpartenr im Haus

- o Belegungszahlen Soll / Ist

- o Gebäudeart

- o Gebäudenutzung

Aus diesen Daten erzeugen wir im Reportgenerator einen Bericht, der dann als Excel-Tabelle an die Zensusstelle gesendet wird. In Hessen nehmen die Gemeinden die Daten in dieser Form an.

Mikrozensus Bund

Beim Mikrozensus des Bundes stellt sich der Fall etwas anders dar. Wir haben hierfür von der statistischen Landesstelle eine Excel-Vorlagendatei erhalten, die ausgefüllt zurückzusenden ist, um dann in die Datenbank des Landes eingespielt zu werden. Um den Prozess möglichst automatisiert zu gestalten ist es nötig, die geforderten zusätzlichen Attribute für das Tabellenformat der Landesstelle in iTWO fm zu ergänzen, bzw. es ist erforderlich zu überlegen, welche vorhandenen Daten nutzbar sind. Dieser Schritt ist recht einfach, denn es werden in den obigen Klassen folgende Punkte ergänzt:

Als Identifikationsnummer in Klasse „Gebäude“ haben wir die Gebäudekostenstelle genutzt.

In der Klasse „Standort“ müssen Straßenname und Hausnummern als getrennte Felder aufbereitet werden. Für eine Adresse mit übergreifender Hausnummer wie „Beethovenstraße 2-6“ sind die Formate etwas anders anzulegen und aufzugliedern:

- 1. den Straßennamen „Beethovenstraße“

- 2. die von-Nummer: „2“

- 3. die bis-Nummer „6“

Diese Formatierung umzusetzen ist zwar etwas Arbeit, bietet aber für die Zukunft diverse Optionen, Berichte zu erstellen, ohne die Daten-Strings immer wieder neu aufbereiten zu müssen.

In der Klasse „Gebäude“ werden noch weitere Attribute benötigt. Aus der Bezeichnung „Energieträger“ wird zum Beispiel eine Kennziffer, gleiches gilt für die Heizung- und Gebäudeart. Hier haben wir in iTWO fm Zeigertabellen angelegt, mit denen wir die Zusatzanforderungen in den Attributen nutzen können.

Für die Landesstelle des Zensus sind zudem alle Mietenden oder Bewohnenden mit Wohnraumfläche und Kaltmiete in einem zweiten Tabellenblatt aufzulisten. Hierfür nutzen wir für jede bewohnende Person die als Identifikationsmerkmal die in der Klasse „Gebäude“ genutzte Kostenstelle als Bezugsreferenz. Somit kann die Zensusstelle die Verknüpfung herstellen, wer in welchem Haus wohnt.

In unserem Fall musste ich hierbei einen etwas umständlichen Lösungsweg gehen, da wir erst dabei sind, das Modul Mietmanagement in iTWO fm zu integrieren. Im CAFM-System haben wir lediglich die Wohnflächen der Bewohnenden im Zugriff, jedoch fehlen ihre Namen und die spezifischen Kaltmieten. Diese haben wir aus unserem Buchhaltungsprogramm bezogen und mittels Excelaustauschdateien die Daten für den Mikrozensus zusammen geführt. Wer bereits das Mietmanagement einsetzt, kann sich diesen Workaround sparen und das vollständige Datenpaket direkt aus der iTWO fm generieren.

Grundsteuerreform

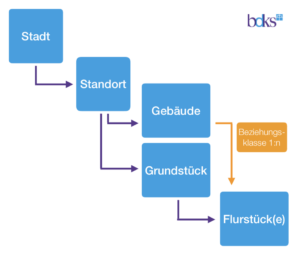

Für die Grundsteuerreform stellt sich der Prozess für fast 150 Gebäude und 1 Mio. m² Grundflächen etwas komplexer dar. Als Basis ist das Grundbuchmodul in iTWO fm notwendig, welches im Grunde ein Flurbuch ist. Das hat Vorteile, denn manchmal stehen Gebäude nicht auf einem Flurstück, sondern auf mehreren, oder auf einem Grundstück stehen diverse Gebäude. Hier haben wir in Abstimmung mit dem Finanzamt die Aufteilungen der Flächen vorab geklärt, damit die Daten passend erfasst werden können.

In iTWO fm arbeiten wir bei uns im Haus mit der folgenden Struktur, die wiederum an den Standard angelehnt ist (Die Klasse „Grundstück“ nutzen wir unter „Standort“):

Zu vereindeutigen ist in diesem Komplex, welches Flurstück welchem Gebäude zugeordnet werden muss. Wir lösen das recht einfach in iTWO fm und ohne die vorhandenen Daten zu verändern. Es muss lediglich zwischen den Klassen „Gebäude“ und „Flurstück“ eine Beziehungsklasse eingerichtet werden, durch die alle Flurstücke eine Zuordnung finden. Ein zusätzliches Attribut mit einem Aufteilungsfaktor löst Sonderfälle bei sehr ungünstigen Konstellationen.

Als Resultat erhalten wir einen recht großen, aber für die Meldung beim Finanzamt nutzbaren Report. Leider nimmt das Finanzamt digitale Daten zum Import nicht entgegen, so dass wir alle Informationen händisch über das Elster-Portal eingeben müssen. Durch die klarer Struktur des Reports sind jedoch alle Daten eindeutig zugeordnet und können von den Mitarbeitenden fehlerfrei online eingetragen werden.

Da in jedem Bundesland die Eingabemasken in Elster etwas anders sind und auch die Grundsteuerverfahren mitunter abweichende Vorgaben haben, ist unter Umständen ein in Details abweichendes Vorgehen notwendig. iTWO fm ist aber flexibel genug, um einen passenden Lösungsweg zu schaffen.

Fazit

Mit CAFM-Software lassen sich kommunaler Zensus, Mikrozensus und Grundsteuerreform recht einfach meistern. Viele grundlegende Daten sind bereits im System gepflegt, mitunter sind Felder zu ergänzen. Notwendige Beziehungen lassen sich leicht herstellen. Die anschließend generierten Reports können beim Zensus direkt an die zuständigen Stellen übergeben werden, bei der Grundsteuerreform dienen sie dem Kollegium als verlässliche Grundlage, um die Elster-Formulare online fehlerfrei zu befüllen.

Beitrag erfasst von: Dipl.-Ing. Georg Daher

Leitung Facility Management

Baunataler Diakonie Kassel e.V.

Sie möchten mehr über iTWO fm erfahren?

Schicken Sie uns Ihre Anforderungen. Oder rufen Sie uns an: +49 2064 4986 0

[tf_popup link="55598"]Jetzt kontaktieren![/tf_popup]